The $100 Million Question: Why "Who Looks Like This?" Is the Most Valuable Query in Business Intelligence

Every strategic decision in business reduces to one foundational question: "Who looks like this?"

Yet most organizations can't answer it accurately. According to AlphaLens's analysis of 4,936 Y Combinator companies, even sophisticated investors systematically misidentify comparables when relying on company descriptions (labs.alphalens.ai). The cost? Billions in misallocated capital, failed acquisitions, and missed partnerships.

The problem isn't lack of data—it's using the wrong abstraction layer. Company descriptions compress multi-dimensional reality into one-dimensional labels, destroying the information needed for accurate comparison. The solution requires analyzing what companies actually build, not how they describe themselves.

The Strategic Cascade: Seven Decisions, One Question

Answering "who looks like this?" accurately triggers a cascade of strategic capabilities, each building on the previous:

Benchmarking → Valuation → Investment Thesis → Acquisition Targets → Partnership Discovery → Sales Intelligence → Competitive Response

Get the first answer wrong, and every subsequent decision compounds the error. Get it right, and you unlock strategic advantages invisible to competitors using category-based analysis.

The Toast Cascade: From Benchmarking to $20B Valuation

Toast's journey from startup to $20 billion IPO illustrates the cascade perfectly:

Early investors benchmarked Toast against "restaurant software" companies trading at 5-7x revenue. This miscategorization cascaded through every strategic decision: VCs capped valuations using restaurant software multiples, growth funds passed because the TAM seemed limited, strategic acquirers overlooked Toast as a payments competitor, potential partners missed collaboration opportunities, enterprise sales teams pitched wrong buying committees, and competitors like Square were blindsided by Toast's payments volume.

The correct comparable set—payments (10-15x), lending (8-12x), and hardware (6-8x)—would have revealed Toast's true trajectory years earlier. One answer, seven strategic implications, billions in value creation or destruction.

The Semantic Collapse: When Everyone Is "AI-Powered"

At time of writing, most newly minted B2B software companies describe themselves as "AI-powered platforms." The phrase has achieved perfect semantic meaninglessness—maximum adoption, zero information content.

When Google Cloud, Salesforce, and your local startup all use identical descriptions, traditional similarity analysis becomes mathematically impossible. The only escape is analyzing actual product capabilities.

The Y Combinator Paradox

Y Combinator backed more than a dozen AI code editors between 2022-2024, including three in the same batch with the same group partner (TechCrunch). Were they confused? No. They understood what category analysis couldn't: Continue, PearAI, Void, and others might all be "AI code editors," but their products target different developer workflows, languages, and integration points.

The Cascade in Action: From Benchmarking to Acquisition

The power of accurate similarity analysis compounds across the strategic cascade:

Valuation: Where Multiples Meet Reality

Stripe's evolution demonstrates valuation complexity. Category analysis sees "payments processor." Product analysis reveals:

- Payment processing (10-15x revenue multiple)

- Business banking (8-12x multiple)

- Revenue operations (12-18x multiple)

- Developer infrastructure (15-20x multiple)

Which multiple applies? All of them, proportional to product revenue mix. Companies using single-category comparables systematically misvalue multi-product platforms.

Investment Thesis: Beyond the Obvious

Bessemer Venture Partners' anti-portfolio documents passing on Shopify at $2 million valuation. Their error wasn't analysis quality—it was analyzing the wrong layer. They saw "e-commerce platform" competing with Magento. Product analysis would have revealed Shopify's payments processing, marketing automation, fulfillment network, and financial services—a platform play worth $61 billion today.

Acquisition Strategy: Finding Hidden Synergies

Microsoft's $19.7 billion Nuance acquisition succeeded where others failed because Microsoft analyzed product complementarity beyond categories. While others saw "speech recognition," Microsoft identified integration potential across Teams (communication), Azure AI (infrastructure), and healthcare cloud (vertical solutions)—product synergies generating $2 billion incremental revenue in 18 months.

Partnership Discovery: Crossing Category Boundaries

When Stripe launched Atlas (incorporation services), they entered legal tech—a category partnership between payments and legal services that traditional analysis would never suggest. Product-level analysis reveals these cross-category opportunities systematically: HR platforms partnering with financial wellness apps, CRMs integrating with customer success tools, project management software embedding communication capabilities.

Sales Intelligence: Targeting the Right Buyer

Enterprise sales fail when companies misidentify their comparables. If you think you're selling "HR software," you target HR buyers. But if product analysis reveals you're actually competing with performance management, employee engagement, and organizational development tools, you need different champions, budgets, and value propositions.

Competitive Response: The Six-Month Advantage

When Zoom added asynchronous video in 2022, category analysis missed it—Zoom was "video conferencing." Product analysis immediately surfaced threats to Loom, Vidyard, and BombBomb. Loom's rapid enterprise pivot and eventual $975 million Atlassian acquisition was enabled by this early warning. Six months' advantage in recognizing competitive threats often determines market leadership.

Beyond Silicon Valley: Global Evidence of Systematic Failure

The categorization crisis extends worldwide:

Fortune 500 Convergence

McKinsey's 2024 analysis found 73% of Fortune 500 companies now compete outside their primary industry classification. Disney competes with Netflix (streaming), Apple (content), and Epic Games (metaverse). Ford competes with Tesla (EVs), Apple (software), and Google (autonomous driving). Categories suggest these companies don't compete—products reveal intense multi-vector competition.

European Hidden Champions

Hermann Simon's research on European "hidden champions" reveals another blindspot. Würth, categorized as "fasteners," generates €20 billion competing with Amazon Business, Grainger, and Fastenal across different product lines. Company-level analysis sees a fastener supplier. Product analysis reveals a logistics, procurement, and supply chain platform.

Asian Super-Apps

Grab, Gojek, and Sea Limited defy Western categorization. Are they ride-sharing, payments, food delivery, or gaming companies? The question itself is wrong. Product analysis shows they're building identical super-app infrastructures with 70% product overlap despite different "primary" categories.

The ROI of Accurate Similarity: Quantified Returns

Organizations implementing product-level similarity analysis report transformative returns:

Bain & Company's M&A Analysis (2023)

Among 312 tech acquisitions, deals based on product complementarity achieved targeted synergies 67% of the time versus 22% for category-matched deals—a $47 billion difference in preserved versus destroyed value.

Insight Partners' Track Record

The PE firm publicly credits "product DNA analysis" for their 3x returns since 2019. Their Veeam investment—categorized as "backup software" but revealed through product analysis to span cloud management, security, and disaster recovery—returned 5x in 24 months.

BCG's Competitive Intelligence Study

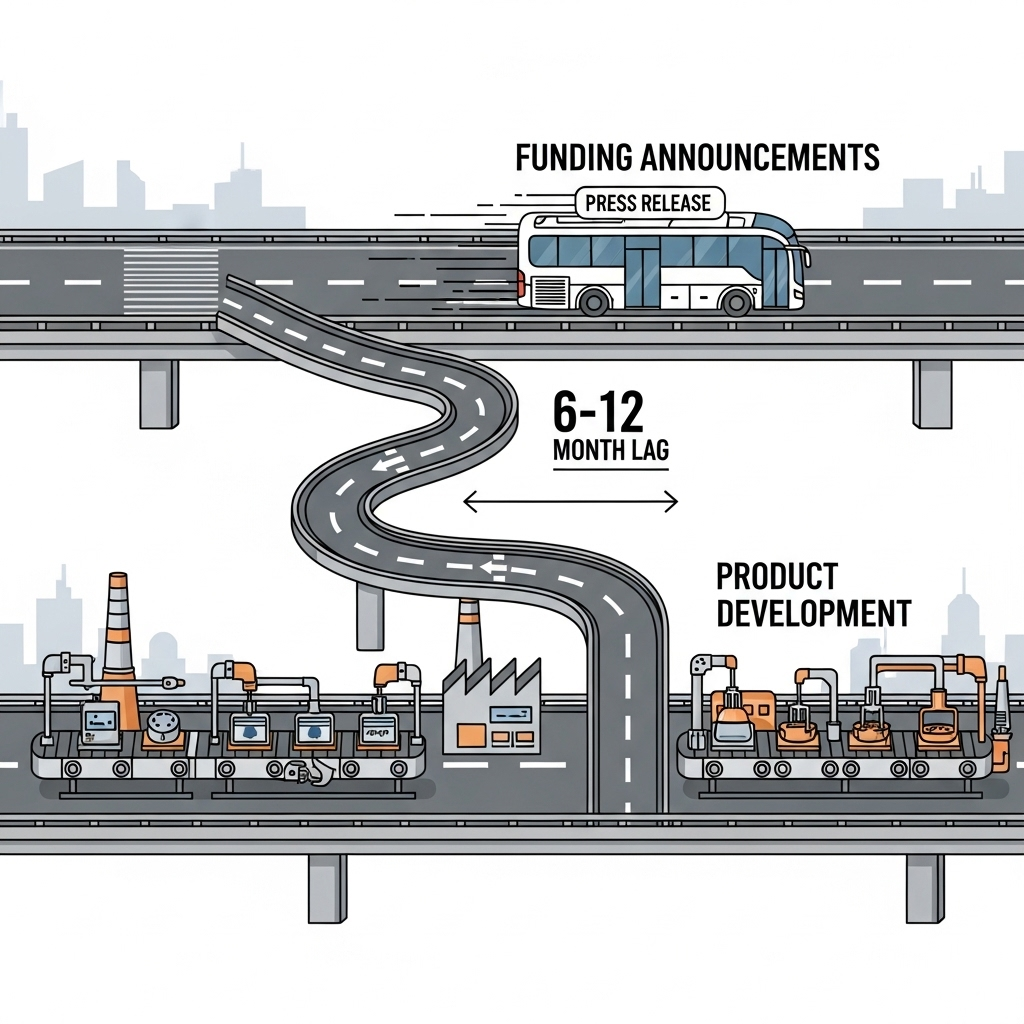

Analysis of 180 companies found those using product-level monitoring identified threats 6-8 months earlier than category-based approaches, reducing competitive response costs by 60-70% and preserving 12% more market share on average.

The Architecture of Accurate Similarity

Solving the similarity problem requires specific technical capabilities:

Semantic Understanding Beyond Keywords

When a fintech's payment feature resembles a bank's digital wallet, or an HR platform's scheduling competes with calendar apps, the system must recognize functional similarity despite zero keyword overlap. This necessitates vector embeddings capturing functional essence regardless of descriptive language.

Cross-Industry Pattern Recognition

Traditional databases organize by industry, making cross-industry discovery impossible. Product-level analysis must transcend these boundaries, recognizing when seemingly unrelated companies build competing products.

Temporal Evolution Tracking

Products evolve monthly while categories persist for decades. As AlphaLens's analysis demonstrates: "A company competes for customers' revenue based on the products and services they have, but the data at this level has been missing from the market for too long" (labs.alphalens.ai).

Platforms solving this analyze millions of products, not thousands of company descriptions. They use AI-powered extraction, vector embeddings, and continuous monitoring to reveal what AlphaLens calls "remarkably relevant competitors" invisible to traditional analysis.

The Future Has Already Been Decided

The companies that accurately answer "who looks like this?" will shape the next decade. They'll value assets correctly while others miscalculate. They'll identify partnerships while others see competition. They'll respond to threats while others remain oblivious.

The evidence is overwhelming:

- Toast's 4x valuation multiple from correct comparables

- 67% M&A success with product versus 22% with category matching

- 6-8 months competitive advantage from product monitoring

- YC backing dozens of "identical" companies that aren't identical at all

The technology exists. Platforms like AlphaLens index 12 million products across 8 million startups, using vector embeddings and AI extraction to answer the similarity question accurately. The ROI is proven across valuations, acquisitions, and competitive strategy.

Y Combinator's portfolio strategy validates this approach. They fund multiple companies in "identical" categories because they understand what category analysis cannot: at the product level, there are no duplicates. Every company's specific features, positioning, and execution create unique positions invisible to category labels.

The foundational question remains: "Who looks like this?"

Answer it wrong, and cascade into strategic failure. Answer it right, and unlock advantages invisible to category-based competition.

Answer the foundational questions on AlphaLens — and unlock the strategic cascade. Get started with AlphaLens on our free tier.